Reimagining enterprise tax software

The challenge

A major initiative of the Central UX group at Thomson Reuters was the reimagining of existing tax products as they were migrated to a unified HTML5/CSS3 platform.

Key to this effort was identifying how the user experience of these products could be improved for TR customers.

The process

A new project typically began with stakeholder and user interviews to understand user and business needs and to establish user personas. Then design workshops were held with key stakeholders to identify and work through high priority design challenges.

User flows, sitemaps and wireframes or prototypes were created and validated with the business and tested with users.

2021-2022

2019-2021

2015-17

The results

User test participants and beta users have been extremely pleased with the new look and feel of ONESOURCE tax products, and truly appreciate the improvements made in usability and intuitiveness.

Sales team members are happy to have a more appealing product to pitch, and implementation and training staff have reported that customers find the new products easier to learn.

Some of the products I’ve worked on include:

ONESOURCE Operational Transfer Pricing

Deliver accurate, consistent global tax reporting results with Thomson Reuters ONESOURCE Operational Transfer Pricing.

ONESOURCE Indirect Tax Compliance

Automate sales and use tax, GST, and VAT compliance in one simple software solution.

ONESOURCE Determination

Automate the calculation of taxes globally with an automated solution for Sales Tax, Use Tax, GST, VAT, and Excise Tax.

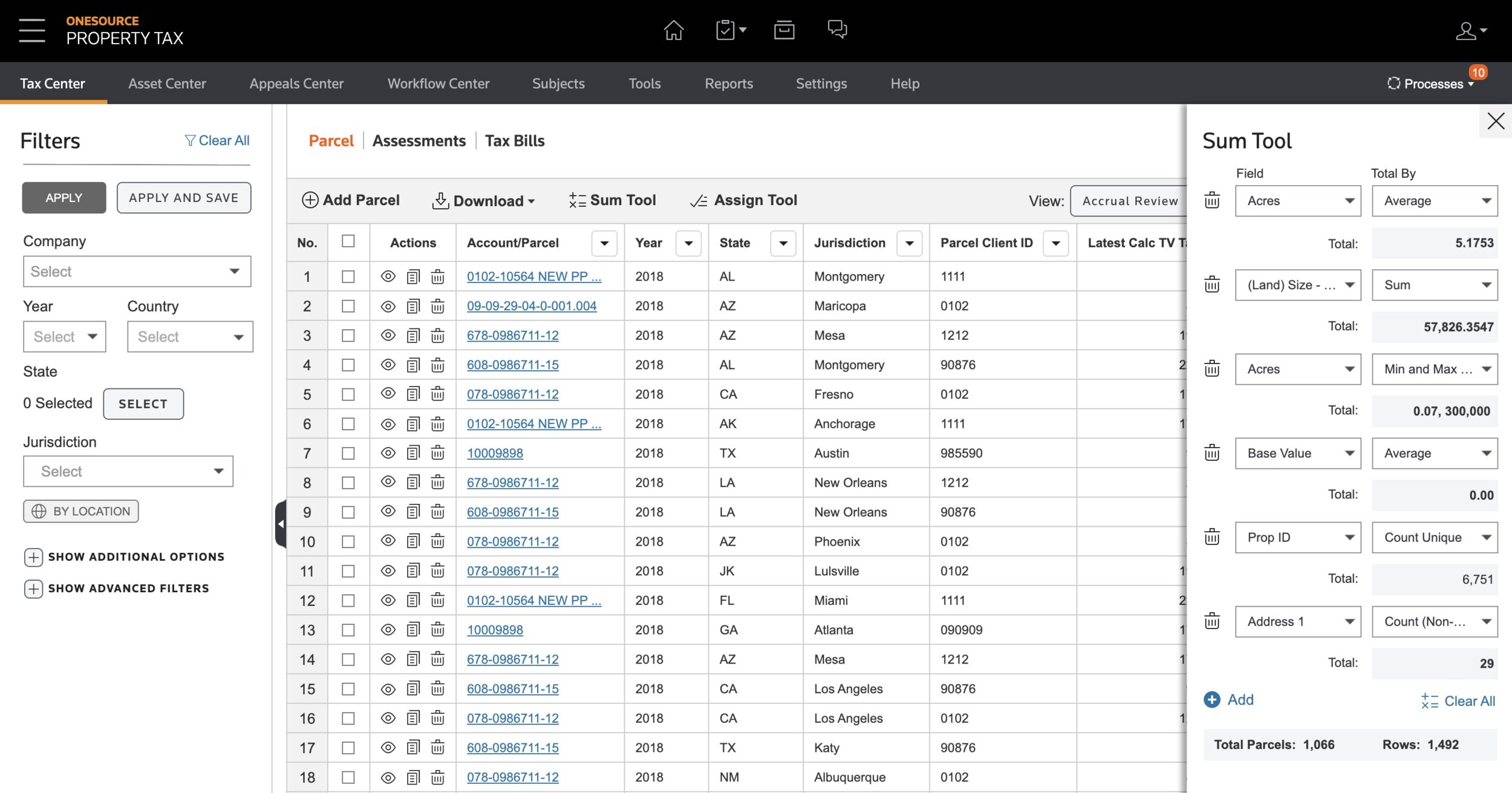

ONESOURCE Property Tax

OPT gives you the management and tax compliance information you need for better, faster decision-making.

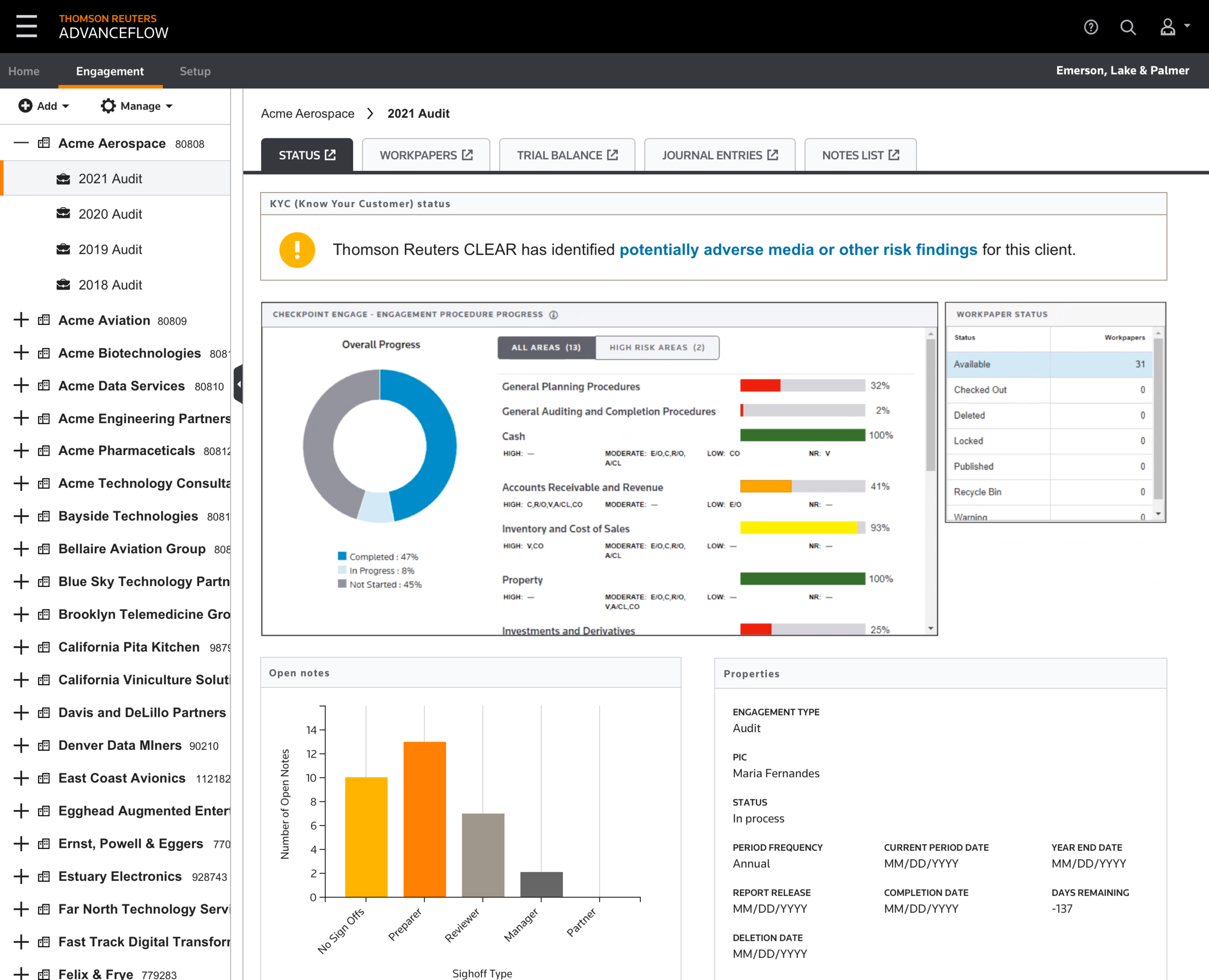

Cloud Audit Suite

Cloud Audit Suite is an end-to-end solution providing accuracy and efficiency throughout the audit process.